Business Tax Services

Proactive tax planning, clean books, and compliance—built into your operations, not rushed at year-end.

Year-Round CPA Advisory

Our Managers Are Business Operators — Not Just CPAs

At MT Bachani CPA, your engagement is led by professionals who have run businesses, held CFO roles, and lived with the consequences of system and tax decisions — not just prepared tax returns after the fact.

Because we’ve operated on the inside, we understand:

What it feels like when systems don’t talk to each other

How tax decisions impact day-to-day operations, not just year-end numbers

The financial and operational cost of bad advice, poor timing, and over-engineering

Why businesses need practical systems that flow, not constant customization and rework

Our leadership team has direct, hands-on experience working inside and alongside businesses across:

Manufacturing — inventory valuation, cost accounting, WIP, and margin control

Real Estate — multi-entity structures, rental portfolios, investor reporting, and tax optimization

E-commerce — sales tax complexity, platform reporting mismatches, inventory flows, and cash management

Medical Facilities — regulatory sensitivity, payroll controls, and clean financial reporting

Hotels & Hospitality — revenue recognition, cost leakage, audits, and operational controls

Restaurants — thin margins, payroll pressure, sales tax accuracy, and real-time reporting

This is why our guidance balances compliance, efficiency, cost control, and sustainable growth — and why we work proactively, year-round, not just at tax filing time.

Who We Help With Business Taxes

At MT Bachani CPA, we prepare, review, and e-file every major business tax return required by the IRS—across all U.S. states.

- LLCs, partnerships, and multi-member structures

- S-Corps needing reasonable compensation + clean K-1s

- C-Corps with book-to-tax differences, credits, NOLs, depreciation

- Multi-state operators (TX + other states)

- Foreign-owned U.S. entities (Form 5472 + related-party transactions)

- E-commerce, manufacturing, real estate investors, and growing startups

Not sure what you are? Ask us — we’ll map the right filing path.

Why MT Bachani CPA

Most firms treat business tax as a once-a-year event. We don’t.

We operate like a CFO + CPA team—connecting your books, processes, tax strategy, and compliance so you can scale without chaos.

CFO-Led Systems Design

We’ve been on the operator side—building reporting structures, improving close cycles, and designing workflows that produce reliable financials (not spreadsheet patchwork)

Deloitte-Trained Process & Controls Mindset

We focus on what prevents problems:

consistent transaction flow

clean supporting documentation

audit-ready reporting

fewer surprises at year-end

Compliance That Protects Owners

Accurate filings reduce:

penalties and notices

sales tax exposure

mismatched books vs returns

ownership and basis mistakes

entity compliance issues (especially foreign-owned structures)

Talk to a CPA Who’s Run a Business

You’re not speaking to a salesperson, a junior advisor, or a purely academic CPA — you’re speaking to someone who has actually operated a business, made real decisions under pressure, managed cash flow, dealt with payroll, systems, taxes, audits, and felt the consequences when things break.

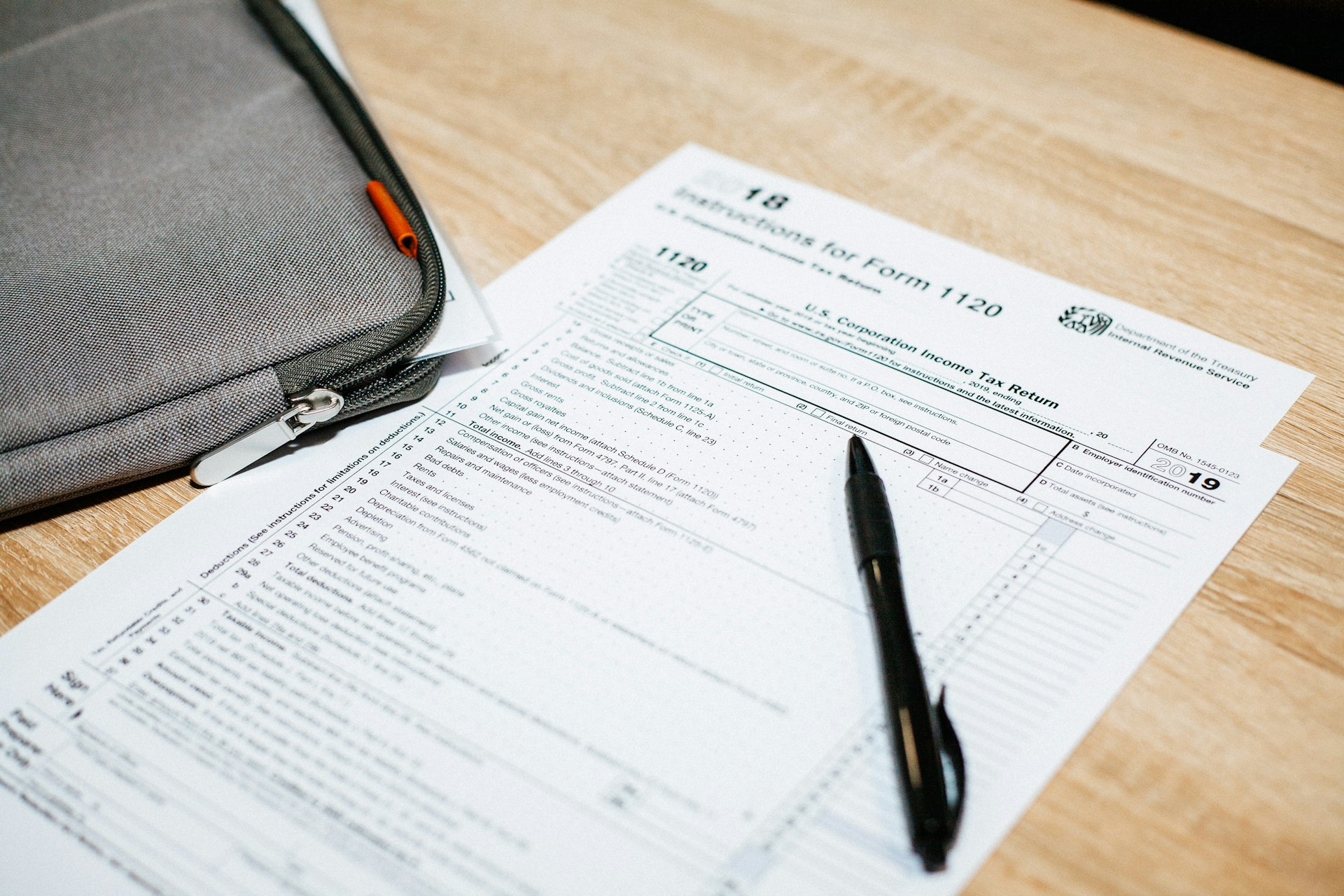

Federal Business Tax Returns

At MT Bachani CPA, we prepare, review, and e-file all major federal business tax returns required by the IRS — for LLCs, partnerships, S-corps, C-corps, estates, trusts, and nonprofits.

Partnership Tax Returns (Form 1065)

We handle complete preparation of partnership tax returns, including income allocation, basis tracking, K-1s, and multi-state reporting.

S-Corporation Tax Returns (Form 1120-S)

We prepare accurate S-Corp filings, shareholder K-1s, basis calculations, payroll integration, and reasonable compensation compliance.

C-Corporation Tax Returns (Form 1120)

We prepare corporate returns, reconcile book-to-tax differences, handle NOLs, depreciation, credits, and state apportionment.

Nonprofit Tax Returns (Form 990)

We assist nonprofits with Form 990 filing, disclosures, functional expenses, public-support tests, and governance reporting.

Foreign-Owned & International Reporting (Forms 8858, 5471, 5472)

We manage foreign-owned LLC compliance and U.S. international reporting, including foreign shareholders, related-party transactions, and controlled entities.

Form 1041 – Estate & Trust Return

We prepare fiduciary returns for estates and trusts, distribute income correctly, and ensure compliance with beneficiary allocations.

Need Accurate Federal Tax Filing?

State-Level Business Tax Returns

Texas Franchise Tax & Other State Franchise Taxes

We prepare franchise tax returns for Texas, California, Delaware, and other states that require annual entity reporting.

State income tax returns

We handle state filing requirements for S-corps, partnerships, corporations, and single-member LLCs operating across multiple states.

Texas Sales Tax & Franchise Tax Compliance

State payroll returns (TX, CA, IL, NY, etc.)

We prepare and file state payroll tax returns, including withholding, unemployment, NYS-45, and other state-specific forms.

We currently file business tax returns for clients in 15+ states, including Texas, California, Illinois, New York, New Jersey, Florida, Colorado, and more.

Comprehensive Business Tax Services

Ongoing Bookkeeping to Support Accurate Tax Filing

Our bookkeeping and accounting practices are designed to free up your time as a business owner, allowing you to focus on the broader goals. We offer monthly reports, suggestions, and evaluations for your business, giving you a clear picture of your overall performance. Bookkeeping services are provided for business tax and compliance clients to ensure accurate filings and reporting.

Business Tax Planning

Strategically plan your taxes to avoid paying excessive amounts, and consider investing in tax-deductible options and strategies. Make the most of available tax deductions to effectively lower your tax burden, allowing you to reinvest the savings back into your business for growth.

Business Tax Compliance

Being compliant with tax laws not only grants you tranquility but also helps you steer clear of costly errors, such as fines, penalties, and the burdensome process of audits. It is important to take preventive actions. Our findings suggest that clients who adhere to tax regulations tend to prosper more, as they implement systems and procedures that ensure compliance.

Business Structure Planning

We analyze your business model and advise on the ideal legal structure—LLC, partnership, S-Corp, or C-Corp—to minimize taxes, protect owners, and support growth. We also guide you through restructuring when your business evolves. .

International & Cross-Border Taxation

We assist businesses with foreign shareholders, international partners, and cross-border operations. This includes Form 5472, 1120-F, withholding requirements, treaty benefits, and compliance for foreign-owned U.S. entities. .

Payroll Processing

Streamline your payroll processing with us to resolve your clerical staff's time management issues while ensuring compliance with labor laws and payroll regulations.

Corporate Workflows

Reengineering business processes enables you to handle a greater number of tasks with limited resources, leading to more time and ultimately more revenue for your business. By improving efficiency, you can minimize the time employees spend on tasks, making their work more interesting and reducing feelings of boredom and monotony.

Corporate Tax Filings

We prepare and e-file business tax returns for partnerships, S-corps, C-corps, nonprofits, and trusts — with multi-state and international compliance support.

Business Taxation Strategies and Planning

Business Tax Services — Scenario FAQs

MT Bachani CPA is led by former CFOs and business operators—not just tax preparers. We provide year-round business tax advisory by aligning accounting, operations, and tax strategy. Our experience spans manufacturing, real estate, e-commerce, healthcare practices, hotels, and restaurants, allowing us to anticipate issues before they turn into audits, penalties, or costly corrections.

Business tax decisions affect more than filings—they impact cash flow, reporting accuracy, compliance, and growth. Our CFO and operator background means we understand how business tax planning interacts with inventory, payroll, sales tax, ownership structure, and financial systems across industries like e-commerce, real estate, medical facilities, and hospitality. This results in cleaner filings, fewer surprises, and structures that scale.

We’ve handled situations where an LLC was formed as single-member but operated with multiple owners. Depending on the facts, the entity may need to be treated as a partnership, and prior filings may require correction to properly reflect ownership and allocations.

Yes. We work with real estate investors who hold properties in multiple LLCs. Each entity generally requires its own tax return, even if ownership overlaps. We also review whether restructuring makes sense for compliance and efficiency.

We assist non-U.S. citizens, visa holders, and foreign owners with U.S. business tax compliance, including entity returns and required foreign ownership disclosures.

We’ve handled multiple foreign-owned U.S. entities that must file Form 5472 due to ownership structure or related-party transactions. We ensure proper filing and assist with IRS notices when this form is missed.

Yes. We have hands-on experience forming and supporting nonprofits, including setting up nonprofit entities (including school structures in Illinois), handling state-level compliance, preparing and filing Form 990, assisting with 501(c)(3) applications, cleaning up nonprofit books, and managing payroll compliance. We understand the unique reporting, governance, and compliance requirements nonprofits face and ensure both federal and state obligations are handled correctly.

We frequently see discrepancies between marketplace reports, sales tax tools, and accounting systems. We reconcile platform data, sales tax filings, and accounting records so reporting is accurate and compliant.

Yes, in many cases. Even when marketplaces collect sales tax, businesses may still have Texas Franchise Tax or other state filing obligations. We review each situation to determine what filings are required.

We’ve worked with e-commerce businesses that triggered multi-state filing requirements due to sales volume, inventory movement, or fulfillment arrangements. We assess exposure and handle the necessary state filings.

We’ve supported manufacturing businesses with cross-border inventory movement involving U.S. and foreign entities. These transactions require proper valuation, documentation, and tax reporting to remain compliant.

This is common when systems like Odoo are implemented without tax oversight. We review inventory costing, intercompany transactions, and accounting setup so financials support accurate tax filings.

We assist businesses operating across multiple states by reviewing nexus, apportionment, and filing requirements to ensure state income and franchise taxes are handled correctly.

We’ve handled startups where ownership changed mid-year. These changes affect allocations, K-1s, and compliance, and must be reflected accurately in the tax return.

We often work with clients whose prior filings don’t align with their books due to system changes, growth, or reporting issues. We reconcile records and correct inconsistencies to ensure accurate filings.

Expert international tax services

- For manufacturers, oil refiners, hotels, banks, shipping companies, EPZs, and NGOs.

- We specialize in cross-border taxation, multi-currency accounting, payroll compliance, and global tax strategies.

- Contact MT Bachani CPA today for trusted financial solutions.